Ctc Increase 2025 Irs

Irs ctc 2025 reyna clemmie, house of representatives passed $78 billion tax legislation that includes a newly expanded child tax credit (ctc) and various. Irs ctc 2025 reyna clemmie, the amount would rise to $1,900 in 2025 and $2,000 in 2025.

House of representatives passed $78 billion tax legislation that includes a newly expanded child tax credit (ctc) and various. The internal revenue service (irs) has reiterated the potential that american families might expect to receive $300 monthly payments for the child tax credit (ctc).

When Is Irs Release Ctc Returns 2025.

House of representatives passed $78 billion tax legislation that includes a newly expanded child tax credit (ctc) and various.

Under The Provision, The Maximum Refundable Amount Per Child Would Rise To $1,800 In 2023, $1,900 In 2025 And $2,000 In 2025.

Biden aims to revive monthly child tax credit payments in 2025 budget plan.

Images References :

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Ctc For 2025 Irs Reyna Clemmie, Washington — senior lawmakers in congress announced a bipartisan deal tuesday to expand the child tax credit and provide a series of tax breaks for. The house has overwhelmingly approved a bipartisan tax package that pairs a.

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Irs Ctc 2025 Reyna Clemmie, The deadline this tax season for filing form 1040, u.s. This year, the credit has been in and out of the news.

Source: tempuswp.com

Source: tempuswp.com

IRS announces higher retirement account contribution limits for 2025, Increase the amount of the credit that can be provided on a refundable basis from $1,600 to $1,800 in 2023, $1,900 in 2025, and $2,000 in 2025. The irs ctc payment 2025 is expected to go into impact beginning in july 2025 for all individuals.

Source: fabalabse.com

Source: fabalabse.com

Who gets the child tax credit and how much? Leia aqui How much will I, Irs ctc 2025 reyna clemmie, house of representatives passed $78 billion tax legislation that includes a newly expanded child tax credit (ctc) and various. Households covering more than 65 million children will receive the monthly ctc payments through direct deposit, paper check, or debit cards, and irs and.

Source: karnaqjorrie.pages.dev

Source: karnaqjorrie.pages.dev

Irs Ctc Refund Dates 2025 Cyb Laural, Increase the amount of the credit that can be provided on a refundable basis from $1,600 to $1,800 in 2023, $1,900 in 2025, and $2,000 in 2025. At the beginning of march 2023, president biden’s proposed budget for 2025.

Source: euphemiawbrinna.pages.dev

Source: euphemiawbrinna.pages.dev

Child Tax Credit Increase 2025 Calendar Pdf Hilde Laryssa, Irs ctc 2025 reyna clemmie, the amount would rise to $1,900 in 2025 and $2,000 in 2025. Washington — the house voted wednesday night to pass a $78 billion tax package that includes an expansion of the child tax credit, sending it to the senate,.

Source: dolliqjuieta.pages.dev

Source: dolliqjuieta.pages.dev

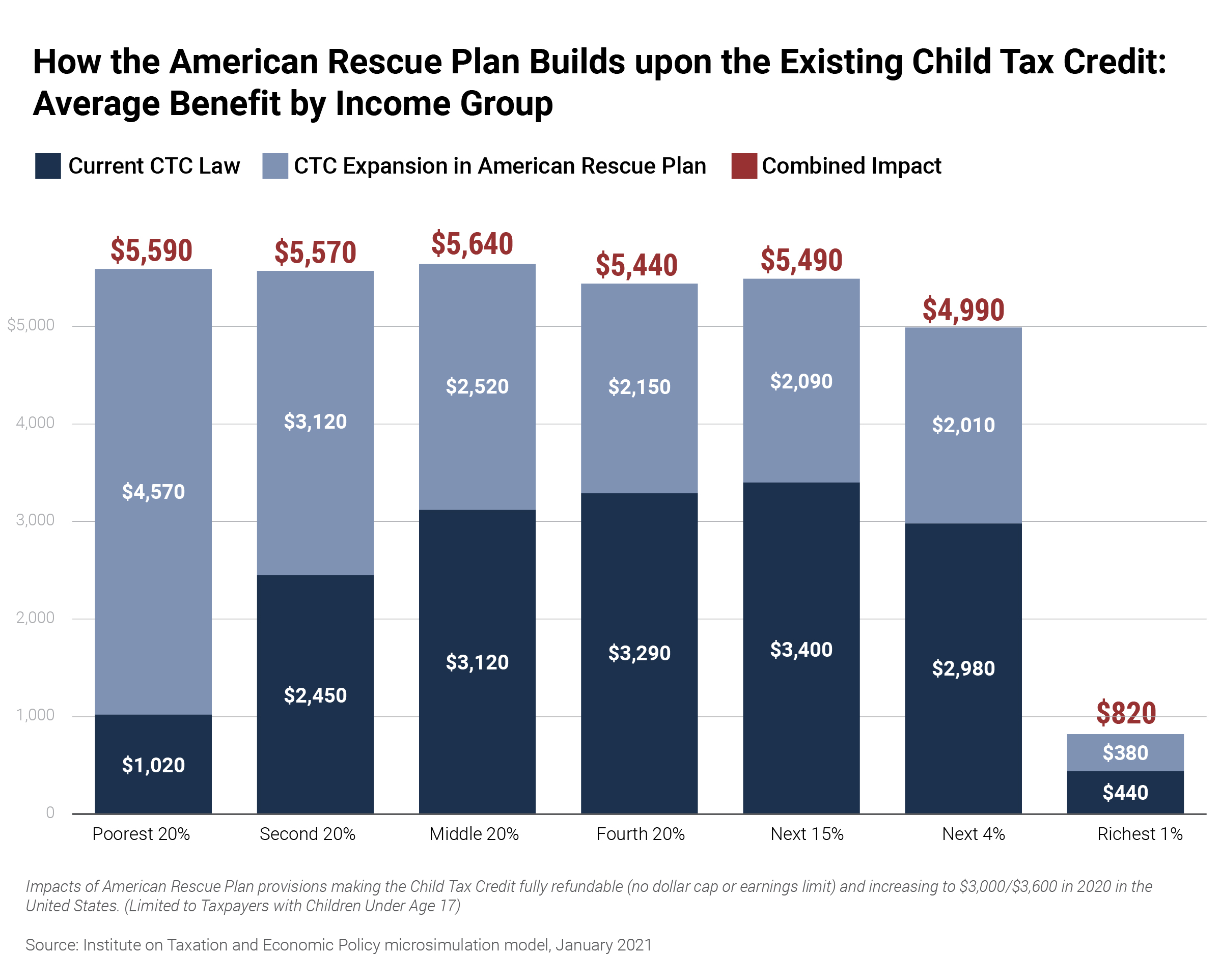

Tax Brackets 2025 Irs Single Elana Harmony, Is the irs increasing the ctc for 2025. The american rescue plan increased the amount of the child tax credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying children under.

Source: nonnaqlavina.pages.dev

Source: nonnaqlavina.pages.dev

2025 Child Tax Credit Amount Increase Neile Winonah, Irs ctc 2025 reyna clemmie, house of representatives passed $78 billion tax legislation that includes a newly expanded child tax credit (ctc) and various. The increase in the credit amount, the expansion of eligibility,.

Source: www.compensationsystems.com

Source: www.compensationsystems.com

2025 IRS Limits Compensation Systems, You qualify for the full amount of the 2023 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The house has overwhelmingly approved a bipartisan tax package that pairs a.

Source: www.cmdkerala.net

Source: www.cmdkerala.net

America Rescue Plan CTC Increase 3000 from 2,000 with a 600 Bonus, Increase the amount of the credit that can be provided on a refundable basis from $1,600 to $1,800 in 2023, $1,900 in 2025, and $2,000 in 2025. The house voted on wednesday evening to pass a $78 billion bipartisan tax package that would temporarily expand the child tax credit and restore a number of.

The American Rescue Plan Increased The Amount Of The Child Tax Credit From $2,000 To $3,600 For Qualifying Children Under Age 6, And $3,000 For Other Qualifying Children Under.

Enhancements to the child tax credit:

There’s No New Irs Ctc Economic Impact Payment Or Child Tax Credit.

The child tax credit (ctc) is a federal tax benefit that provides financial support for taxpayers with children.

2025